Blog

Search

Blog

Bills to Slide Back Federal Beer Taxes

February 18, 2015

Two competing bills to cut excise taxes for beer producers have been introduced by Congress. In the 23 years that have passed since the last increase, the government has lost millions in inflation erosion, and economic harm from excessive alcohol consumption now costs U.S. governments over $94 billion a year. If either bill is enacted, millions more in tax revenue will be lost.

Bills to reduce beer excise taxes have provided a national stage for this industry food fight, complete with hundreds of hours of face-time for beer lobbyists to cement their influence on members of Congress. The Beer Institute (BI), a producer trade group led by the Big Beer Duopoly, has been behind annual bills to slash excise taxes for all brewers for years. The Brewers Association began its promotional efforts for an annual bill to decrease beer taxes in 2011, and the two industry groups have been at it ever since.

This year's BI bill, House Bill 767, would eliminate or lower excise taxes on the first 2 million barrels and extend tax breaks to beer importers. The bill would cost $113 million per year in lost taxes. The BI spent $2.1 million in 2014 alone lobbying Congress, their number one issue to oppose any increase in the federal excise tax.

Senate Bill 375, the latest from the Brewer's Association, would cut the excise tax rate for all beer producers, regardless of size. The bill would cost $64 million per year in lost taxes. This would allow A-B InBev and MillerCoors each an extra $870,000 in tax savings each year; A-B InBev reported $43.2 billion in revenue in 2013, and SABMiller, MillerCoors's parent company, reported $34.5 billion.

88,000 people in the U.S., 1 in 10 working-aged adults, die each year from excessive alcohol consumption. Alcohol excise taxes are the most effective public health intervention to reduce excessive consumption and alcohol-related harm. Instead of allowing beer producers to whittle away at effective public health policy and government tax revenues, Congress should consider a reasonable beer tax increase.

View state and federal bills on alcohol taxes here.

NYC Campaign to Free Public Transit from Alcohol Ads

February 18, 2015

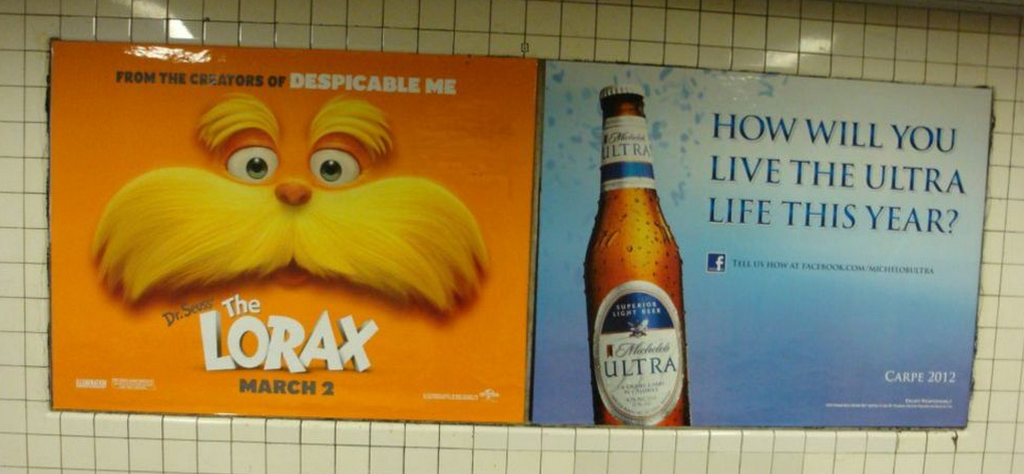

A new campaign to ban alcohol ads on public transit in New York City (NYC), Building Alcohol-Ad Free Transit (BAAFT), has signed on a bevy of supporting partners, including public health advocates, businesses, and medical, religious, youth, and educational organizations. NYC's Metropolitan Transportation Authority's (MTA) current policy specifically allows alcohol ads in trains, buses, shelters, and stations. According to BAAFT, thousands of youth ride MTA buses and trains every day, and 600,000 students receive MetroCards each year.

NYC lags behind other major metropolitan areas, such as Seattle, San Francisco, Boston, and Philadelphia, and most recently, Los Angeles, in taking steps to remove alcohol advertising from public transit. Exposure to alcohol advertising is related to earlier and greater alcohol consumption among youth, and public health advocates like Alcohol Justice have long advocated for the removal of alcohol ads on public property.

For more information in the BAAFT campaign, and to sign the petition to remove alcohol advertising from NYC public transit, click here.

State Bills Would Allow Local Bars to Extend Sales Hours

February 18, 2015

States including Massachusetts, Michigan, and Nebraska have introduced legislation that would allow bar hours to be extended, allowing extensions ranging from several hours more a day to 24 hours a day.

While the hospitality, tavern, nightclub, and alcohol industries supporting these bills argue that later bar hours will help local economies and increase safety, such bills create unnecessary risk of increased consumption, impaired driving, injuries, crime, violence, noise, and nuisance concerns. They create an extra burden for law enforcement and state and local regulators as well. Excessive alcohol consumption already costs federal, state and local governments $94 billion a year in economic harm; in Nebraska, this cost is $476 million; in Michigan, $3.51 billion; and in Massachusetts, $2.17 billion. The Community Preventative Services Task Force recommends maintaining existing limits, or expanding current limits, on hours of alcohol sales as an effective public health policy to reduce excessive consumption and alcohol-related harm.

Proposals that would extend alcohol availability and increase consumption and harm fly in the face of millions of dollars states already spend on the costs of emergency and medical care, law enforcement, legal and social services due to alcohol-related harm - not to mention noise, trash, and other local problems that communities have to clean up.

Read Alcohol Justice's letter opposing a 2013 California late-night bill here.

IOGT on Alcohol & World Cancer Day 2015

February 18, 2015

To mark World Cancer Day (February 4), IOGT international published a sobering reminder that alcohol consumption is the second most significant risk factor for developing cancer. The blog calls for decisive action by governments and non-governmental organizations (NGOs) to reduce alcohol-related cancer by implementing evidence-based alcohol policies that reduce consumption, including: restriction of advertising and promotion; increasing alcohol taxes; and reducing access and availability. Pointing out that the alcohol industry aggressively perpetuates myths to deny the harm caused by alcohol consumption, the blog also recommends focusing on raising awareness that alcohol causes cancer.

Read Alcohol Justice's fact sheet about alcohol and cancer here.

More Articles ...

Help us hold Big Alcohol accountable for the harm its products cause.

| GET ACTION ALERTS AND eNEWS |

STAY CONNECTED    |

CONTACT US 24 Belvedere St. San Rafael, CA 94901 415-456-5692 |

SUPPORT US Terms of Service & Privacy Policy |

Copyright © 2026 Alcohol Justice. All Rights Reserved.

Joomla! is Free Software released under the GNU General Public License.