Why you should be worried about the impending big beer merger!

July 14, 2016

By Pamela Erickson

Healthy Alcohol Marketplace

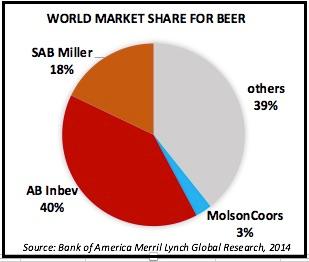

Last October, the world's largest beer producer, Anheuser-Busch InBev (ABI), announced it would purchase the second largest producer, SABMiller. Both companies are global enterprises with ABI headquartered in Belgium and SABMiller in the UK.

Whenever the number one and number two companies combine, red flags are raised. For the US, this would mean a combined company market share of around 70%. Knowing this would raise red flags with anti-trust authorities; ABI subsequently announced they would "divest" SABMiller's US assets by selling them to MolsonCoors, the third largest company in the US market. The companies suggested this would leave the US beer market much as it is today with two major players. Of course, whether this will happen remains to be seen. The reality is that MolsonCoors loses its partnership with a bigger player (SABMiller) and must compete with an even bigger ABI.

What is clear is ABI's aggressive move to dominate the beer market to the greatest extent possible. This should not surprise anyone as this is what large corporations are about. They are governed by investors who seek increased profits. All corporate executives understand that failure to deliver ever-increasing profits will jeopardize their jobs. As a result, corporate executives strive to dominate or monopolize their market if at all possible.

This situation is of great concern because market domination of alcohol sales usually produces serious social problems. In fact, our regulatory system is specifically designed to prevent such domination due to our experience with severe problems before Prohibition.

As historian Bill Rorabaugh notes, "...in the late 1800s and early 1900s, powerful, vertically integrated distillers and brewers controlled production, distribution, and retail sales through exclusive sales outlets. Brewers and distillers forced these 'tied houses' to push sales, and in this brutally competitive market, desperate saloonkeepers doctored merchandise, served children, catered to drunkards, offered backroom gambling and prostitution, and played key roles in corrupt political machines."

We can see modern examples of market domination in the United Kingdom, Australia and New Zealand where hyper competitive supermarkets dominate markets. These companies are "vertically integrated" in the sense that they buy directly from producers in large quantities at deep discount. This enables them to promote alcohol aggressively and sell it cheaply in high volume.

All of those countries have attributed the resultant social problems to these business practices.

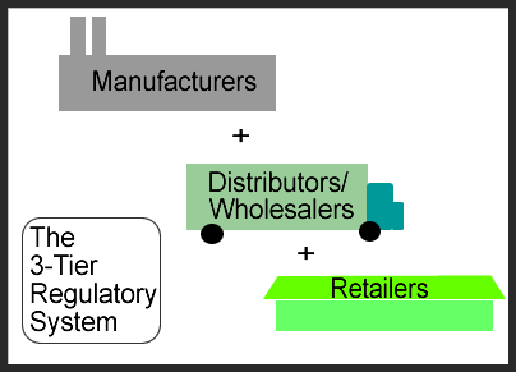

In establishing various states' regulations, Rorabaugh notes that, "The most important innovation...was the separation of producers, distributors, and retailers into a three-tier sales distribution system." By requiring independent tiers, the distributor insulates the retailer from the power of the producer and the producer from the power of the retailer. The system also has several other advantages. Since all producers have to use a state-licensed distributor, that makes it easier for national producers to follow each state's laws. Distributors also collect taxes and track all products for quality control. This system has been credited with the flourishing of small brewers, wineries and distilleries because regulations do not allow the business ties between producer and retailer which would keep the small guys out of the market. In addition, costs of distribution are much lower to smaller producers due to the mature, independent distribution system.

ABI has recently succeeded in moving into the small brewer, distribution and retail sectors via selective moves in areas with weak or unclear regulation. They've done it by purchasing distributors and craft brewers with retail locations. A few states allow a producer to own a distributor; and, as a result, ABI is now the top distributor by sales according to Beer Business Daily. They own 17 distributorships in 10 states. They are the fastest growing beer distributor in the country. By purchasing craft breweries from across the US, ABI has amassed a portfolio of beer products that can displace regional products. Some of those craft purchases involved brew pubs which means that ABI is now present in all three tiers of our system. Distribution and retailing are profitable businesses so they represent substantial profit growth opportunities for ABI.

ABI has also embarked on internal and external incentive programs to promote growth and market domination. Last November, they announced a program of cash reimbursements for independent distributors who sell a high percentage of ABI products. Through this program a distributor whose sales are 98% ABI products could gain as much as $1.5 million! This plan alarmed craft brewers who viewed it as a way to squeeze them out of the market. Internally, ABI set a highly ambitious goal of more than doubling current revenue by 2020. The company has challenged internal staff to help achieve this goal via performance incentives. While the company hasn't said how they will increase revenue, a large increase in alcohol sales could adversely impact efforts to reduce social problems.

Those who crafted our alcohol regulations had another concern about market domination. It was the likelihood that a dominant company would amass enough political and economic power to tear down regulatory restraints. A continued push for further deregulation is something to watch out for.

The US anti-trust authorities have not yet approved the merger. This provides an opportunity to highlight some truly critical issues such as ensuring the integrity of the three tier system. In a letter to Attorney General Loretta Lynch, several US Senators urged careful scrutiny of the merger proposal to "investigate whether distributors owned by these companies also need to be divested." They also note a concern about domination of supplies such as hops, barley, wheat, bottles and cans to the point where small brewers cannot procure such necessary products. Finally, there should be heightened concern about exclusive dealing including some assurance that past violations will not reoccur. Recently, Washington State sanctioned ABI for engaging in an exclusive agreement with a licensed establishment.

Many have noted that once mergers are approved, it is hard to get the toothpaste back in the tube! Therefore, it is important that communities, policy-makers and regulators be diligent in enforcing market rules of fairness so that large and small businesses can continue to operate profitably in our local markets.

https://www.washingtonpost.com/business/beer-merger-would-worsen-existing-duopoly-by-ab-inbev-sabmiller/2013/02/01/efa78ce8-6b1c-11e2-af53-7b2b2a7510a8_story.html

http://www.businessinsider.com/sabmiller-2015-9

http://www.wsj.com/articles/craft-brewers-take-issue-with-ab-inbev-distribution-plan-1449227668

http://m.golocalpdx.com/news/merkley-urges-doj-to-protect-craft-brewers

Quotes from Professor Bill Rorabaugh's expert witness testimony in Costco Wholesale Corp. v. Hoen, 522 F.3d 874 (9th. Cir. 2008) used with permission.

http://www.katzamericas.com/blog/beer/list-top-30-us-beer-distributors/

Help us hold Big Alcohol accountable for the harm its products cause.

| GET ACTION ALERTS AND eNEWS |

STAY CONNECTED    |

CONTACT US 24 Belvedere St. San Rafael, CA 94901 415-456-5692 |

SUPPORT US Terms of Service & Privacy Policy |